Fraud Detection Model

What is Fraud Detection Model?

Fraud Detection Model: Enhancing Security in Financial Transactions

In today’s digital age, where financial transactions are increasingly conducted online, the risk of fraud has also risen significantly. Fraudsters are constantly finding new ways to deceive individuals and organizations, making it essential for businesses to have robust fraud detection models in place to protect themselves and their customers. In this article, we will explore the importance of fraud detection models and how they can enhance security in financial transactions.

The Need for Fraud Detection Models

With the increasing use of digital payments and online banking, the risk of fraud has become a major concern for businesses and consumers alike. According to a report by the Association of Certified Fraud Examiners, global organizations lose an estimated 5% of their annual revenue to fraud. This staggering figure highlights the need for effective fraud detection systems to safeguard financial transactions and prevent losses.

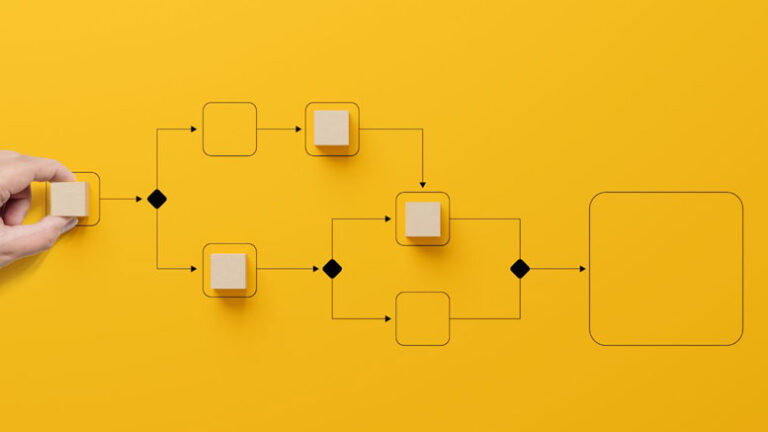

Fraud detection models are designed to identify and prevent fraudulent activities by analyzing patterns, trends, and anomalies in transaction data. These models use advanced algorithms and machine learning techniques to detect unusual behavior and flag suspicious transactions for further investigation. By leveraging technology and data analytics, businesses can proactively identify and mitigate fraud risks before they escalate.

Types of Fraud Detection Models

There are several types of fraud detection models that businesses can implement to protect themselves against fraudulent activities. Some of the most common models include:

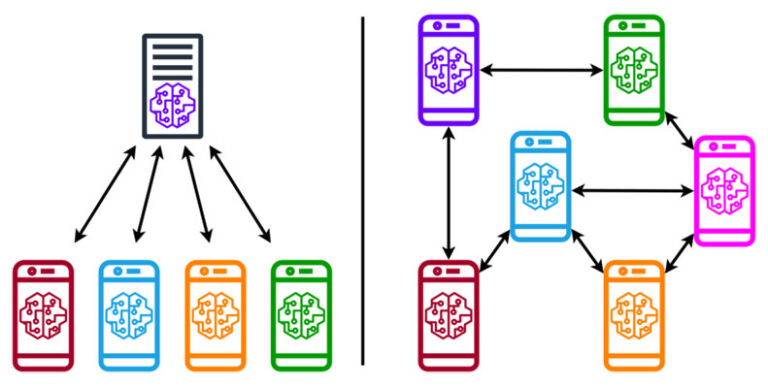

1. Rules-based models: Rules-based models rely on predefined rules and thresholds to flag suspicious transactions. These rules are based on known patterns of fraudulent behavior and are constantly updated to adapt to new fraud tactics. While rules-based models are effective in detecting known fraud patterns, they may not be as effective in identifying new and emerging fraud schemes.

2. Anomaly detection models: Anomaly detection models use statistical analysis and machine learning algorithms to identify unusual patterns and outliers in transaction data. These models can detect deviations from normal behavior and flag transactions that fall outside the expected range. Anomaly detection models are effective in detecting unknown fraud patterns and can adapt to changing fraud tactics over time.

3. Machine learning models: Machine learning models use complex algorithms to analyze large volumes of transaction data and identify patterns and trends that indicate fraudulent activity. These models can learn from past transactions and continuously improve their accuracy in detecting fraud. Machine learning models are highly effective in detecting sophisticated fraud schemes and can provide real-time alerts to prevent fraudulent transactions.

Benefits of Fraud Detection Models

Implementing a fraud detection model offers several benefits for businesses, including:

1. Improved security: Fraud detection models enhance the security of financial transactions by identifying and preventing fraudulent activities before they cause significant losses. By proactively detecting and stopping fraud, businesses can protect their assets and reputation.

2. Cost savings: Detecting and preventing fraud early can help businesses save money by avoiding financial losses and reputational damage. Fraud detection models can also reduce the time and resources spent on investigating fraudulent activities, leading to cost savings in the long run.

3. Enhanced customer trust: By implementing robust fraud detection models, businesses can demonstrate their commitment to protecting customer data and financial transactions. This can help build trust and loyalty among customers, leading to increased customer satisfaction and retention.

Challenges of Fraud Detection Models

While fraud detection models offer numerous benefits, they also come with certain challenges that businesses need to address. Some common challenges include:

1. False positives: Fraud detection models may generate false positive alerts, flagging legitimate transactions as fraudulent. This can lead to inconvenience for customers and impact the efficiency of the fraud detection system.

2. Data quality: The accuracy and reliability of fraud detection models depend on the quality of the data they analyze. Poor data quality can result in inaccurate fraud detection and false alerts, undermining the effectiveness of the system.

3. Evolving fraud tactics: Fraudsters are constantly evolving their tactics to circumvent fraud detection systems. Businesses need to continuously update and enhance their fraud detection models to stay ahead of emerging fraud schemes.

Conclusion

In conclusion, fraud detection models play a crucial role in enhancing security in financial transactions and protecting businesses from fraudulent activities. By leveraging advanced algorithms and data analytics, businesses can proactively detect and prevent fraud, reducing financial losses and safeguarding customer trust. While fraud detection models come with certain challenges, businesses can overcome them by investing in robust technology and data management practices. With the right fraud detection model in place, businesses can effectively mitigate fraud risks and ensure the integrity of their financial transactions.